Kane County Cannabis – Is It Legal & Where To Buy 2026

- Illinois Cannabis

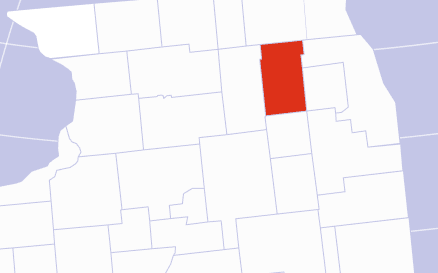

- Kane County Cannabis

Is Cannabis Cultivation Legal in Kane County?

Yes, cannabis cultivation is legal in Kane County. On January 1, 2020, adult-use cannabis became legal in Illinois, while medical use has been legal in the State since 2014. In accordance with the Compassionate Use of Medical Cannabis Pilot Program, the cultivation centers of licensed cannabis businesses shall be:

- Maintained in a clean and orderly manner

- Free from infestation by birds, rodents, vermin, or insects of any kind

- Producing useable cannabis and cannabis products that are intended for human consumption alone

- Having a storage area that provides adequate ventilation, humidity, temperature, lighting, sanitation, equipment, space, and security conditions for cannabis production

- Having another storage area intended for cannabis that is outdated, deteriorated, damaged, misbranded, or adulterated and whose packaging has been breached or opened

Aside from cultivation centers, cannabis can be homegrown by patients registered under the State’s Compassionate Use of Medical Cannabis Pilot Program with the following restrictions:

- The grower must be the owner of the residence or has permission from the landlord prior to growing cannabis

- The grower is limited to cultivating not more than five plants that are five inches or taller

- The grower must take precautions to prevent unauthorized access to cannabis plants

- If the grower violates the Act's regulations, that grower is liable for penalties, including the loss of homegrown privileges.

The Illinois law also says that cannabis cultivation must occur indoors, in an enclosed and locked area that is out of public sight.

Is Cannabis Manufacturing Legal in Kane County?

Yes. As defined in the Cannabis Control Act of Illinois, cannabis manufacturing includes the production, preparation, propagation, processing, conversion, or compounding of cannabis by extraction from natural cannabis.

Section 1000.405 of the Compassionate Use of Medical Cannabis Pilot Program says that the cultivation facility where cannabis plants will be manufactured into an edible form shall meet the requirements stated in the Food Handling Regulation Enforcement Act, Sanitary Food Preparation Act, and Illinois Food, Drug and Cosmetic Act. In line with that, the Illinois Department of Public Health may at all times conduct random inspections in premises occupied for the production, storage, preparation, and manufacture of medical cannabis products.

To apply for a cannabis manufacturing business, Illinois Administrative Code 1000 states that they shall meet the following criteria and measures:

- Cultivation Plan (30%)

- Business Plan and Business Services to be Offered (10%)

- Suitability of the Proposed Facility (15%)

- Proposed Staffing or Employee Plan and Knowledge of the Laws of Illinois Relating to Medical Cannabis (10%)

- Security Plan (20%)

- Product Safety and Labeling Plan (15%)

Is Cannabis Retail Legal in Kane County?

Yes, cannabis retail is legal in Kane County. The Cannabis Regulation and Tax Act of Illinois states that The Department of Financial and Professional Regulation shall enforce and oversee the provisions of this Act relating to the licensing and registration of dispensing establishments.

According to Sections 1-5 of the Act:

- Persons must show proof of age prior to purchasing cannabis

- Only legitimate, licensed, and taxpaying businessmen, and not criminal actors, are authorized to conduct sales of cannabis

- Selling, distributing, or transferring cannabis to minors or persons below 21 years old is illegal

- Purchasers of cannabis must be informed of health risks associated with the use of cannabis as supported by evidence-based research and peer-reviewed research

- Operating a snowmobile or a watercraft, or driving vehicles under the influence of cannabis is illegal

- Cannabis sold in Ilinois will be labeled properly and tested randomly, subject to additional terms to ensure that purchasers of cannabis are well-informed and protected

Furthermore, Section 15-25 of the Act states that the licensed dispensing organization must agree and comply with a physical location for retail within the first 180 days since the date of the award. That location must not be situated within 1,500 feet of another existing dispensing establishment. However, if the applicant cannot find a suitable location within the first 180 days, the Department of Financial and Professional Regulation may give an allowance or extend the period for finding a retail store address for another 180 days.

According to Illinois’ Cannabis Regulation and Tax Act, cannabis forms that can be sold in the State include edibles, ointments, oil, beverage, and tincture.

In Kane County, recreational cannabis dispensaries shall operate between 6:00 am and 10:00 pm. There shall be no more than one cannabis dispensary approved in the unincorporated areas of Kane County.

Is Cannabis Delivery Legal in Kane County?

Yes, cannabis delivery is allowed in Kane County, but only among licensed cannabis businesses, including craft growers, dispensing organizations, cultivation centers, testing facilities, or infuser organizations. The Cannabis Regulation and Tax Act, Section 40-25, states that all cannabis delivered by a cannabis transporter must be encoded or entered into a data collection system and sealed in a secure container. Transporters are also subject to unannounced or random inspections by the Illinois Department of Agriculture, the Illinois Department of Public Health, and the Illinois State Police.

Meanwhile, cannabis delivery for patients with medical marijuana ID cards is still not allowed in Illinois. Senate Bill 2404, a bill that would allow the delivery of adult-use and medical cannabis to patients and consumers in the State, is still pending approval.

How to Get Medical Marijuana Card in Kane County

To be eligible for a medical marijuana card in Illinois, the patient must:

- Be at least 18 years of age

- Be an Illinois resident during the application process and must remain a resident during participation in the program

- Have a qualifying, debilitating medical condition

- Have a signed healthcare practitioner’s certification for medical cannabis

- Complete the fingerprint-based background check

- Not have been convicted of crime or excluded offense

Debilitating conditions include:

- Autism

- Causalgia

- Agitation of Alzheimer’s disease

- Amyotrophic lateral sclerosis (ALS)

- HIV/AIDS

- Anorexia nervosa

- Cancer

- Cachexia/wasting syndrome

- Arnold-Chiari malformation

- Chronic inflammatory demyelinating polyneuropathy

- Crohn’s disease

- Chronic pain

- Hydrocephalus

- Hydromyelia

- CRPS (complex regional pain syndrome Type II)

- Ehlers-Danlos syndrome

- Dystonia

- Fibrous Dysplasia

- Glaucoma

- Hepatitis C

- Migraines

- Multiple Sclerosis

- Interstitial cystitis

- Irritable bowel syndrome

- Lupus

- Muscular Dystrophy

- Myasthenia Gravis

- Myoclonus

- Nail-patella syndrome

- Neurofibromatosis

- Neuro-Bechet’s autoimmune disease

- Post-Concussion Syndrome

- Traumatic brain injury

- Neuropathy

- Osteoarthritis

- Residual limb pain

- Seizures (including those characteristic of Epilepsy)

- Parkinson’s disease

- Tourette syndrome

- Post-Traumatic Stress Disorder (PTSD)

- Reflex sympathetic dystrophy

- Rheumatoid arthritis

- Severe fibromyalgia

- Polycystic kidney disease (PKD)

- Spinal cord disease

- Spinal cord injury

- Syringomyelia

- Spinocerebellar ataxia

- Superior canal dehiscence syndrome

- Sjogren’s syndrome

- Tarlov cysts

- Ulcerative colitis

You may fill out the application form prepared by the Illinois Department of Public Health, pay a $100 application fee through check (payable to Illinois Department of Public Health) or credit, then mail it to:

Illinois Department of Public Health

Division of Medical Cannabis

535 West Jefferson Street

Springfield, Illinois 62761-0001

For more information, you may also contact the Illinois Department of Health at 217-782-4977 or 312-814-2793.

How Has Cannabis Legalization Impacted the Economy of Kane County?

According to a February 2022 Economic Forecast report by the Commission on Government Forecasting and Accountability, Illinois generated more than $1 billion in cannabis sales in 2021, gaining more tax revenue than alcohol sales. The figure shows that cannabis contributes to the economic progress of Illinois.

In the State of Illinois, cannabis sales are taxed at 10% for cannabis with tetrahydrocannabinol (THC) levels of 35% or below; 25% for cannabis with tetrahydrocannabinol (THC) levels above 35%; and 20% for all cannabis products, including edibles.

Starting May 1, 2021, Kane County has imposed a County Cannabis Retailers’ Occupation Tax of 2.5% on the gross receipts from retail sales of recreational cannabis. This is in addition to

the State Cannabis Retailers’ Occupation Tax (6.25%).

The Effects of Cannabis Legalization on Crime Rates in Kane County

Statewide, the FBI crime database reported a decrease in DUI cases in Illinois from 2018 to 2019 and 2020, from 2,815, 392, and 231 arrests, respectively.

For the total drug-related arrests in Kane County from 2018 to 2020, data published by the Illinois State Police annual crime report revealed a decrease in the number of cases from 1,283, 1,239, and 940, respectively. Note that the legalization of recreational cannabis in the State took effect in 2020.

Cities Dispensary