Cook County Cannabis – Is It Legal & Where To Buy 2026

- Illinois Cannabis

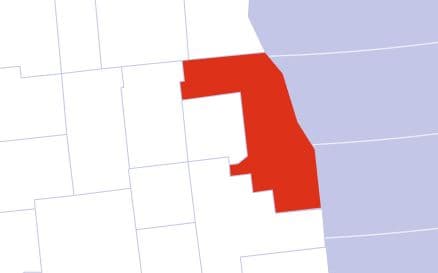

- Cook County Cannabis

Is Cannabis Cultivation Legal in Cook County?

Yes. Cannabis cultivation is legal in Cook County pursuant to the Illinois Cannabis Regulation and Tax Act (CRTA). Also, following the legalization of medical marijuana under the Compassionate Use of the Medical Cannabis Program Act, registered patients with medical marijuana (MMJ) cards are permitted to cultivate cannabis indoors, subject to certain restrictions. Cook County residents who do not possess MMJ cards cannot cultivate cannabis indoors.

Besides holding an MMJ card, to cultivate cannabis indoors for medicinal purposes, an individual must be aged 21 or older and may not cultivate more than five cannabis plants at once. Each of the cultivated cannabis plants may be at least five inches tall and must be cultivated indoors in locations that are secure and locked away from public view. Illinois cannabis cultivation law also requires that a cannabis cultivator in Cook County obtain the permission of the residential property owner before commencing cannabis cultivation on the property. Although recreational or adult-use cannabis is legal in Illinois under the Cannabis Regulation and Tax Act (CRTA), Cook County pursuant to the CRTA, prohibits the indoor or home cultivation of cannabis for recreational purposes. Penalties for the cultivation of cannabis other than for legalized purposes and beyond the stipulated limits include prison terms of up to 15 years and fines reaching $100,000.

In Cook County, the outdoor cultivation of cannabis is only permitted to licensed cannabis cultivation centers and craft growers. A craft grower is authorized to cultivate cannabis in an area of up to 5,000 square feet of canopy space within its approved facility for cannabis plants in the flowering stage. In addition, the state’s Department of Agriculture may authorize an increase of the canopy area for cultivation in increments of 3,000 square feet by rule based on market need, the growing capacity of the licensee, and the licensee's history of compliance. The maximum canopy area that may be approved for a craft grower is 14,000 square feet for cultivating cannabis plants in the flowering stage.

Cook County places the following limitations on craft growers in the county:

- A craft grower facility may not be located in any area zoned for residential use

- A craft grower facility may not be located within 1,500 feet of another craft grower or cultivation center

- Licensed cannabis cultivation centers may cultivate up to 210,000 square feet of canopy space for cannabis plants in the flowering stage for adult-use cannabis

Is Cannabis Manufacturing Legal in Cook County?

Yes. Cannabis manufacturing is legal in Cook County. Licensed infusers typically conduct cannabis manufacturing in Cook County. Infusers are authorized to directly incorporate cannabis or cannabis concentrates in product formulations to produce cannabis-infused products.

Cannabis infusers in Cook County may not be located in any area zoned for residential use. In the Cook County seat of the City of Chicago, a cannabis infuser establishment may not be located within 660 feet of a residential district. A licensed infuser may share premises with a craft grower or a dispensing organization as long as each licensee stores their monies and cannabis in separately secured vaults to which the other licensee does not have access. An infuser may share a vault with a craft grower or dispensing organization if both licensees sharing the vault share more than 50% of the same ownership. Other regulations for cannabis manufacturing in Cook County are contained in Section 35-25 of the Cannabis Regulation and Tax Act.

Is Cannabis Retail Legal in Cook County?

Yes. The retail sale of medicinal and adult-use cannabis is legal in Cook County. Medical cannabis sales can only be made to patients with valid registrations under the Medical Cannabis Patient Program, while adults aged 21 and above can purchase recreational cannabis within the stipulated limits from licensed dispensing organizations in Cook County. The following are operational regulations for dispensing organizations in Cook County:

- Dispensing organizations may only operate between 6:00 a.m. and 10:00 p.m. local time

- Dispensing organizations may only sell cannabis through vending machines, drive-through windows, and transport to residences or other locations where purchases may be for delivery

- A dispensary organization is prohibited from operating when the video surveillance equipment installed in the dispensing premises is inoperative

- A dispensary organization is prohibited from operating when the point-of-sale equipment is inoperative

- A dispensary organization is prohibited from operating when the state's cannabis electronic verification system is inoperative

- A dispensary organization's operation is prohibited when fewer than two people are working at any time within the dispensing organization

- A dispensary organization may not sell any product containing alcohol except tinctures, which are limited to containers no larger than 100 milliliters

- A dispensing organization may not sell clones or other live plant materials

- A dispensing organization may not sell cannabis, cannabis concentrate, or cannabis-infused products in combination or bundles with each other for one price

- A dispensing organization may not obtain cannabis or cannabis-infused products from outside the State of Illinois

- Any cannabis product sold by a dispensing organization must be held in a sealed or resealable container or package with a label. The label must identify the name of the dispensing organization, the weight and content of the raw cannabis in grams, or for cannabis products, and the amount of THC in milligrams

- A dispensing organization is not permitted to be located within 1,500 feet of the property line of a pre-existing dispensing organization

- A dispensary organization must comply with the security provisions outlined under 410 ILCS 705/15-100

For additional regulations and operational requirements for dispensing organizations in Cook County, review Article 15 of the Cannabis Regulation and Tax Act.

Is Cannabis Delivery Legal in Cook County?

Yes. Cannabis delivery in Cook County is permitted in accordance with Article 15 of the Cannabis Regulation and Taxation Act. While cannabis delivery is legal, the Illinois CRTA only legalizes the delivery of cannabis to restricted access areas. Pursuant to Section 15-7-(f) of the CRTA, cannabis deliveries may not be accepted through the public or limited access areas except otherwise approved by the Illinois Department of Agriculture.

How to Get Medical Marijuana Card in Cook County

The medical marijuana (MMJ) card is an identification card qualifying the person named on the card to legally obtain and use medicinal marijuana within the stipulated limits. To be eligible to hold a medical marijuana card in Cook County, an individual must be registered under the Illinois Medical Cannabis Registry Program and suffer from one of the approved medical conditions. The medical conditions for which Illinois doctors may recommend the use of medical marijuana include:

- Hydrocephalus

- Ehlers-Danlos syndrome

- Post-Concussion Syndrome

- Post-Traumatic Stress Disorder (PTSD)

- Hepatitis C

- Interstitial cystitis

- Residual limb pain

- Syringomyelia

- Muscular Dystrophy

- Severe fibromyalgia

- Parkinson’s disease

- Chronic inflammatory demyelinating polyneuropathy

- Chronic pain

- Agitation of Alzheimer’s disease

- Osteoarthritis

- Spinal cord injury or disease

- CRPS (complex regional pain syndrome Type II)

- Cachexia or wasting syndrome

- Fibrous Dysplasia

- Polycystic kidney disease (PKD)

- Lupus

- Crohn’s disease

- Ulcerative colitis

- Dystonia

- Amyotrophic lateral sclerosis (ALS)

- Tourette syndrome

- Neuropathy

- Multiple Sclerosis

- Neurofibromatosis

- Glaucoma

- Neuro-Bechet’s autoimmune disease

- Tarlov cysts

- Myoclonus

- Spinocerebellar ataxia

- Reflex sympathetic dystrophy

- Cancer

- Nail-patella syndrome

- HIV/AIDS

- Hydromyelia

- Rheumatoid arthritis

- Autism

- Causalgia

- Sjogren’s syndrome

- Arnold-Chiari malformation

- Superior canal dehiscence syndrome

- Traumatic brain injury

- Myasthenia gravis

- Migraines

- Irritable bowel syndrome

- Anorexia nervosa

- Seizures (including that characteristic of epilepsy)

Besides suffering from any of the qualifying conditions, an applicant for an MMJ card must also:

- Be an Illinois resident when applying and remain so during participation in the medical cannabis registry program

- Have a certification electronically submitted by a health care professional for the use of medical cannabis. Note that the healthcare professional must be a licensed physician or osteopath pursuant to the Medical Practice Act of 1987, possess a controlled substance license under Article III of the Illinois Controlled Substances Act, be in good standing to practice medicine in Illinois, and have a bona fide physician-patient relationship with the patient seeking medical cannabis certification

- Not hold a school bus permit or Commercial Driver's License

- Not be an active-duty law enforcement officer, correctional officer, correctional probation officer, or firefighter

- Possess proof of identity, such as a State of Illinois-issued identification card and government-issued passport

Once you meet all required criteria and possess the requisite documentation, you may initiate the application process online by selecting MCPP Patient Registration on the Illinois Cannabis Tracking System (ICTS). During the application on the ICTS, you will be required to pay an application fee which varies depending on the selected MMJ card term length and the number of registered caregivers. Typically, this fee ranges from $25 - $300. Applicants who qualify for reduced application fees may be eligible to pay approximately half of the usual fee. Applicants enrolled in the federal Social Security Disability Insurance (SSDI) or the Supplemental Security Income (SSI) disability programs are eligible for reduced fees. Veterans may also submit copies of DD214 forms to qualify for reduced fees.

Upon completing the application, the Illinois Department of Public Health may take up to 30 days to review the submission. If an application is successful, the applicant will receive a digital marijuana card through the online cannabis tracking system (ICTS), which may be printed for use to obtain medical marijuana. Note that the State of Illinois no longer issues physical medical marijuana cards. Medical marijuana cards in Cook County are valid for one, two, or three years depending on the term selected while completing the application process.

For more information on applying for medical marijuana cards for minors and eligible caregivers, visit the medical cannabis page on the Illinois Department of Health website. For more information on obtaining medical marijuana cards in Cook County, contact the local health department at:

Department of Public Health Administrative Office

7556 Jackson Boulevard

Forest Park, IL 60130

Phone: (708) 836-8600

Email: healthycook@cookcountyhhs.org

OR

Illinois Department of Public Health

Division of Medical Cannabis

535 W. Jefferson Street

Springfield, IL 62761-0001

Phone 1: (855) 636-3688

Phone 2: (217) 782-3300

E-mail: DPH.MedicalCannabis@illinois.gov

How Has Cannabis Legalization Impacted the Economy of Cook County?

Following its legalization of medical and recreational cannabis, Illinois has experienced an economic boost through the income generated from taxes imposed on cannabis and cannabis products. According to a research brief published by the Illinois Institute for Rural Affairs, marijuana sales in Illinois exceed $660 million as the state collected in excess of $175 million in tax revenue in 2020.

Starting from July 2020, Illinois authorized its counties to collect taxes on recreational marijuana sales. In addition to local and state retail taxes, county governments are permitted to levy an additional 3.75% tax on retailers' gross receipts from the sales of adult-use cannabis. Cook County's tax rate is 3.0% for all locations in the county, including all unincorporated areas. Note that municipalities may also impose their own tax. For instance, the City of Chicago levies a 3.0% tax on retail sales of adult-use cannabis. Hence, in addition to the state levy of a 10% excise tax and a 6.0% sales tax, the total tax paid by a City of Chicago resident on cannabis purchase within the city boundaries is 16.0%.

Per the 2021 Annual Report of the Illinois Department of Financial and Professional Regulation (IDFPR), dispensing organizations in the City of Chicago, the seat of Cook County, accrued $32,682,059 in revenue from the sale of adult-use cannabis between July 2019 and June 2020. In the same period, dispensing organizations in the city made sales worth $29,275,921 in medical cannabis. Between July 2020 and June 2021, the figures were $144,701,315 and $72,760,554 for revenues generated by dispensing organizations in adult-use cannabis and medical cannabis sales in Chicago respectively.

The 2021 IDFPR annual report also indicated that the City of Chicago recorded $7,030,786 million in cannabis tax revenue between January 2020 and June 2020. Between July 2020 and June 2021, dispensing organizations in the City of Chicago recorded $45,243,458 in cannabis tax revenue. Also, according to the research published by the Illinois Institute for Rural Affairs, Cook County generated an estimated $16 million in total tax on cannabis sales between July 1, 2020, and April 30, 2021.

The Effects of Cannabis Legalization on Crime Rates in Cook County

With recreational sales of cannabis only starting in 2020 in Cook County and official DUI arrests figures currently only available up till 2020, the impact of recreational cannabis legalization on the county's crime rate may only be determined when new data become available. However, according to research published by the UIC (University of Illinois), using data obtained from the Illinois Secretary of State, DUI arrests figures in the State of Illinois dropped yearly from 2014 to 2017. Note that the legalization of medical marijuana went into effect in 2014.

Prior to the legalization of medical cannabis in Cook County, the county recorded 10,175, 10,390, and 10,264 DUI arrests in 2011, 2012, and 2013. In the following years, Cook County recorded 9,719 and 9,419 DUI arrests in 2014 and 2015. Cook County's arrest rates for DUI decreased further in 2018, 2019, and 2020 as the reported figures were 7,714, 7,830, and 5,425, respectively.

Also, according to a report published by the LUC (Loyola University Chicago), with data obtained using the Uniform Crime Report (UCR) system, Cook County has witnessed declining violent and property crime rates from 2014 onwards compared to the preceding years.

Cities Dispensary